How To Succeed In Options Trading Where Others Have Failed!

Most people go about options trading all wrong. They make the same mistakes. So, in this article, I’m going to show you how to dodge some of the most commonly made mistakes in options trading. Here we go!

- The first thing I see options traders do is to go for the cheap priced options. However, options are fairly efficiently priced, in that, the cheap options have a slim chance of winning (being in the money) at expiration. More expensive options are generally more expensive because of their greater chance of being in-the-money at expiration or before.

- Buying options has less success generally than selling options. However, when buying options, traders tend to buy 30-60 day options because they’re cheaper but they also have less time to be right and reap a profit. When buying options, you should be buying far more time than you think you’ll ever need. As a general rule, I say to figure out how much time you’ll need on the option and then add an additional 60-90 days to that number, at a bare minimum. What you’ll find is that you almost never regret buying too much time but you can regret buying too little time. Buying less time is cheaper, but is cheaper for a reason…because it has less time to be right. If you’re interested in option buying strategies, I’d encourage you to check out my e-book, which will show you how to have a statistical advantage through these six strategies:

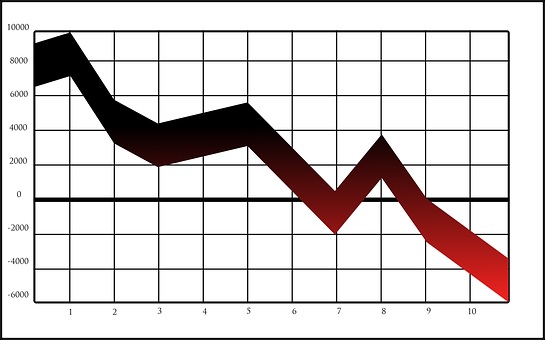

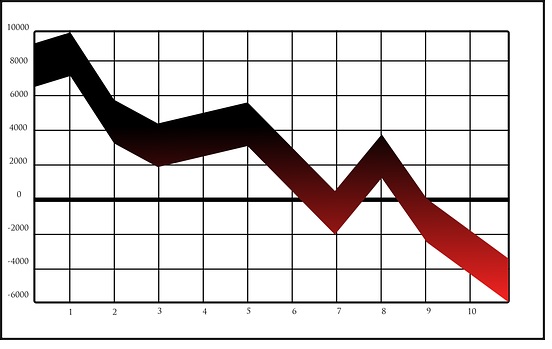

- In options trading, sellers of options have a statistical advantage over buyers of options. For one, the time decay causes the clock to be ticking away against the option buyer. However, time decay is actually to the sellers advantage, particularly in the final 30-60 days in a contract when the time erosion is the fastest/greatest in an options contract.

- Options traders also “get it wrong” because they only think of price and its direction. They think buy a call if they think the stock is going up and buy a put if they think the stock is going down. However, there are several components that factor into an option contract’s price and the direction of the stock is only one of them. The three most important factors in an options contract is: price/direction, time and volatility. Options are fairly efficiently/properly priced as it concerns the first two components but what an option is many times “off” on is the volatility piece of the option’s price. What you’ll find is that options tend to be a bit overpriced on the sell side of the contract, especially when the stock has a high implied volatility. The option seller wants to sell-to-open contracts that are likely overpriced with high implied volatility and buyers want to try to buy potentially under-priced options that have low implied volatility. This can be figured out much easier than you think. In fact, I can show you ONE indicator that figures this out for you and the indicator is free. If you’re interested more along those lines, I’d urge you to check out my options report on it. For any donation of $100 to my www.paypal.com account (shmcc2000@hotmail.com), I can email the Word document of that report to you. It also talks about how to earn income with options as well.

- In that same report above, I can show you how to couple that one indicator with one more indicator to give you an edge whether you’re buying or selling options contracts.

- In stock trading and also in stock investing, many people like to buy when the stock turns upward and sell when the stock’s momentum turns downward. However, with options, you’re better off in buying when a stock is getting slammed to the downside and selling after the stock has surged to the upside and the upward momentum is beginning to start to taper off. Why? In both instances, the volatility component in the option’s pricing will be more likely to be in your favor. Again, in the option’s report mentioned above, there’s more of a measured way of doing this that doesn’t leave anything to the imagination. Literally two indicators tell you when its better to sell or buy.

- Options traders make huge mistakes by placing stop-loss orders on options trades. Options are much more volatile than the underlying stock that it’s tracking. Therefore, these exaggerated swings would be much more likely to hit your stop-loss and take you out of your trade. So I don’t suggest using them. After all, if you’re using an option strategy that has limited risks, then your biggest risks are typically in just losing the premium you paid for the option (like in buying a call or buying a put contract). By the way, don’t attempt options strategies with unlimited risks without having quite a bit of experience.

- Dodge a lot of potential potholes along the way by trading index options rather than individual stock options. By trading options on the S&P 500, NASDAQ or Russell 2000 small cap index, you’ll be dodging individual stock risks but you’ll also be dodging things like earnings reports coming out that are near-term “unknowns” that could have outcomes where the market trades against your position (by the position surging in the opposite direction) and you don’t have to worry about increased options exercises because a stock is about to pay out a quarterly dividend, etc. So index options require a bit less work and you don’t have to be aware of earnings reports or dividend payout schedules, etc.

In options trading, you don’t want to “chase stocks’. Instead, you want to anticipate the expected moves. For instance, if the stock is surging higher, you don’t want to buy because the volatility component of the options contract is expanding and working against you as a buyer. And if the stock is selling off hard, you don’t want to sell-to-open because the volatility component is collapsing against you and quickly shrinking up the options premium you’re looking to take in as income.

Therefore, if you’re an “okay” market timer and you want to hone your skills, I’d urge you to check my my e-book above, Option Trading Demystified. If you don’t have a good read on stocks and their direction, then you may want to use higher probability options which are on the sell-side and consider my options report mentioned above. It will give you the two indicators that take the guesswork out and the time-erosion factor on an options contract will work in your favor, especially with option contracts that are 30-60 days or less until expiration.

- Make sure to factor the “time” element of an options contract. For instance, if you’re a seller of an options contract, all days that chip away off of the contract are not created equal. The early days in an options contract don’t erode in time value all that fast off of an options price like the final 30-60 days in an options contract. So if you’re a buyer of an options contract, NEVER buy an option that’s just 30-60 days until expiration and if you’re a seller of an options contract (selling to open), then you’d want to highly consider selling a contract that’s 60 days or under until expiry so that you can have the speed of time decay working in your favor in the contract. But either route you go (buying or selling), make sure to put time on your side.

- Sellers of options get paid to take on risks. Buyers of options have to pay to take on risks. This reason alone gives option sellers a huge advantage over time. Between this advantage and time being on the option seller’s side, one should highly consider being a seller of options. More on that in my options report that you can get via the $100 donation to my PayPal account. I’ll also include my options trading e-book in it for free for you as well. So you’ll get the best of both worlds.

- You can’t ONLY get the direction of a stock right and always win with options. You have to also make sure that you’ve picked the contract correctly to where time is on your side and most importantly that the volatility component is on your side (which can be found in that one indicator I mentioned above. That way, you can see it visually/graphically displayed with its own high and low readings).

These are the top areas where I see options traders mess up. If you can dodge these mistakes and instead trade them like I’ve suggested above, then you’ll have a much better shot at success than those who fall into these option trading pitfalls above.

God bless!

Leave A Comment

You must be logged in to post a comment.