Don’t Count Commodities Out!

There are periods when commodities trade in a range and traders and investors act like they’re “down for the count”. However, if one knows their commodity history, they know it would be a novice mistake to believe that commodities won’t come back alive again.

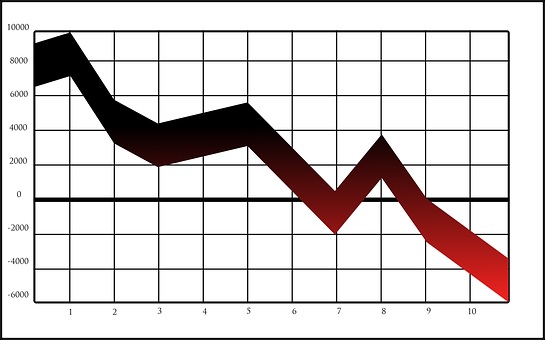

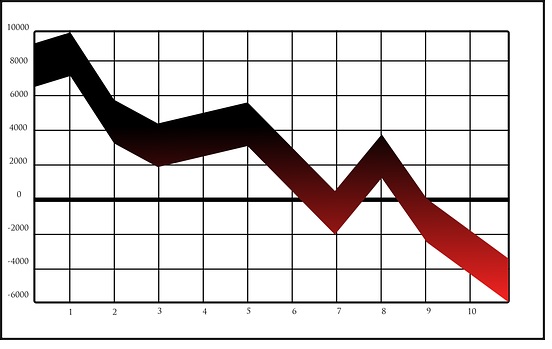

Let’s take a look at what commodities did (through the CRB Commodity Index) below, from 1970-present.

Once we came off the gold standard, no doubt, commodities ratched up to a new permanent level higher (as you can see at the far left of the chart).

But commodities, just like any other asset, go through periods of both trends and ranges. And when the trends are happening, you can’t get anyone to think they’ll end. And when ranges are happening, you can hardly get anyone to believe they’ll snap out of those ranges. But history shows us that commodities don’t stay low forever.

Sometimes, it may seem like “forever”. After all, in the early- to mid-1970’s, there was a seven year period when commodities didn’t do much. But look at the massive rallies before and after that period!

And again, in the late 1990’s to early-2000’s, there was a five year period where commodities didn’t do much of anything (as they remained within a range). However,…look at the strong trend that came out of that period.

Well…here we are again! 3.5 years into a sideways range (technically a very, very mild uptrend which feels like a range). I can’t tell you if this range ends tomorrow or a year or two from now but what I can tell you is that gold is already breaking out higher. Oil is firming up. And agricultural commodities may be showing some of their first signs of life in a while.

Another thing that could propel commodities higher is the dollar getting ready to dive, on the back of interest rate cuts from the Federal Reserve. A decline in the dollar, by itself, helps commodities to generally head higher.

So don’t make the novice mistake of counting commodities out. They will rally once again, and that also means inflation will rise once again.

For a while, we’ve been spoiled in a low inflation environment. And Americans are even struggling in that type of environment. Imagine when the cost of commodities (which are the necessities of life) rise, how it will affect them then!

They’re not prepared. But you can be prepared and come out unscathed by positioning your money and investments to prosper from this coming rise in commodity prices/inflation.

Note: If you’re viewing this and you’re not prepared or don’t know how to prepare for what’s to come, join us at www.seanhyman.com . Subscribe to the monthly newsletters and weekly videos there so that you can learn how you can position your assets to where they don’t suffer during the next bout of inflation that’s coming!

God bless!

Leave A Comment

You must be logged in to post a comment.